MRNA Body Sharing

Reply

Just another day? Yes and no.

Yes, it’s just another day. The Sun appeared where I am at, and the sky is clear for another bright day.

…and

No. It’s a special and unique day according to the Gregorian Calendar. This year is a leap year, What does that mean? Simply put, today is the 29th day of February which normally contains 28 days.

How come?

Well, let me say it this way. Man and his system fucked up the calendar—the Gregorian Calendar. There I’ve said it.

I’ve read and studied the calendar system and the whole story is absurd. In one word it’s CRAP! They ALL say that the Universe is at fault and Astrologers and Mathematicians are in cohorts.

Blame it on the Sun and Moon! Who created them?

Ahaa! So the Creator fucked up?

They can argue all they like all their lives and I won’t care.

Hey! Btw, where’s the AI?

You see, they won’t allow AI in on this, because it will fucked up ALL the HOLY days and holidays(?) and un-merry the Christmas? NO…that’s bad for business.

…and ALL other HOLY days(?)

Whoops! I don’t mean to rock the religious boats. That’s another banger for another day.

Anyway, my birthday which is supposed to be today, is put forward tomorrow. That’s OK! Thank God I was not born in a Leap Year.

Thank you, Mum! Thank you, Sir!

Mad respect for my Maker, The ONLY Perfect ONE.

Original posting on Substack

..

|

⛎

Love On WheelsIf There’s A Wheel There’s A WayBook Project The story outline. This book is based on a true story. A love story about a young man who was paralyzed head down after a motorcycle accident. Bedridden, he struggled to find his way back to his life. A young woman who was a schoolmate came to visit him a few years later and she was taken by his courage in overcoming adversity in a brave manner not often seen. They fell in love. He wished to marry her, but her father was against it as could be expected of any father, given his circumstances. Against all odds, they strived and continued to be together with great hopes that in time their dream would come true. Eleven years passed by and her unconditional love for him proved too strong for anyone who tried to stop them. Her father realized how much she loved him and finally relented. They got married. Life is like a box of chocolates filled with an assortment of fate and destiny. After removing the obstacles in their way, the happy couple now looked forward to a blissful life together, not knowing there was a mountain ahead waiting for them to climb. Their honeymoon was interrupted when they were confronted with a hammer threatening to shatter the dream that had just come true. The odd couple was now up against all odds and their strengths were put on trial as they struggled to be together. Theirs is a great story for all to see and learn from. This is a story of the power of love The love that dare not speak its name. Can love conquer all? … The Book

.. |

I’m always being asked, “What do you do?“

“Whatever it takes,” my answer.

And should they ask, “…and what’s that?“

“You’re special dumb to ask and for me to explain.“ I’d say.

“Don’t try“ – Charles Bukowski

If you’re interested read this letter

It’s okay, keep on asking me if you don’t mind my (only) answer.

In a mad world, only the mad are sane.

Absolute M. A. D. (mad and dumb)

… ask Alfred E Neuman

I AM crazy, but in sanity … read slowly

My Strawman died many moons ago.

Knowing the difference is the difference.

Original post at Substack (read and listen 🎧 )

..

Just for the record

The Sun is up this morning, but there’s still A LOT of BULLSHIT in the air.

The bigger bullshit is

The above story is a good picture and a very fine example.

Do you see it? Many don’t.

Forget the details of the story, which is in and of itself—bullshit

Let me explain…

Both are fictional Legal Entities.

It means both are CORPORATIONS—bu$iness entitie$

Pfizer is, of course. No argument there.

What about Poland(?), which is known to you and I—as a (sovereign) country and run by a government (politicians) elected by the people (slaves/stocks). That’s the bullshit.

FACT I — It is NOT.

FACT II — It is a CORPORATION and so are ALL the countries on EARTH.

The Legal BS system practiced on Earth proves it. Ask every any good or (especially bad stupid) bad lawyers about The Law of Contract. Who are the parties in a contract?

If you are like most people who are not familiar of (Man made) laws, you’ve been conned all your lives up-down-left-right.

If you don’t get it, it’s not my job to explain or teach.

All I can and DARE say, “Patriotism is just garbage“

…stop the (stupid) vote, it only encourages them to enslave you perpetually.

Originally posted on Substack

..

Man is forgetful. That is human.

Sadly ironic he (conveniently) forgets to become one.

“You are not your job, you’re not how much money you have in the bank. You are not the car you drive. You’re not the contents of your wallet. You are not your fucking khakis. You are all singing, all dancing crap of the world.”

Chuck Palahniuk

Be human first and your do’s-and-don’ts will be remarkable. Ask Alfred E. Neuman

Prime Ministers and Presidents the politicians they are, forget they’re MPs too. A flaw (by design?) in the world system of government, which impugns the over glorified doctrine of The Separation of Powers. Don’t ask the lawyers.

To begin with, they are themselves citizens, supposed to be working for and representing the citizens in their constituency instead of oppressing the very people they represent.

Politics is low vibration pastime. It’s just pea-brained MPs yackety-yacking in Parliament wasting people’s time and energy. Emptying the National coffers—proving with gusto how ignorant, inefficient, horrible and disgusting they are.

The Constitution “has either authorized such a government as we have had, or has been powerless to prevent it.” – Lysander Spooner

Man is most times lost in the dust of his own raising. If that’s not bad enough, he dusts the people around him.

Be a good person, but don’t waste time to prove it (a real shitty habit)!

Dust off.

Be human —foremost to hindmost.

Always ALL ways.

..

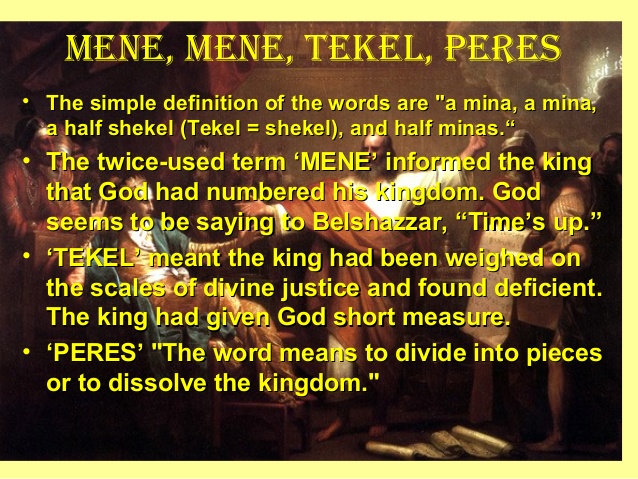

TIME

The Separator

There is no time.

What does that tells us?

It’s a spatial effect illusion

Mental as it may be.

Seek ye and learn that Time is the secret whereby ye may be free of this space.

Literally, there is no time. There’s only NOW.

Metaphorically, the Universe waits for no one…so don’t wait.

..

WYSIWYG. I learned that when I took up computer learning some four decades ago

What-you-see-is-what-you-get. That’s what GUI offers on the screen – Graphical User Interface

Now let’s go to the much bigger super-duper screen—The World

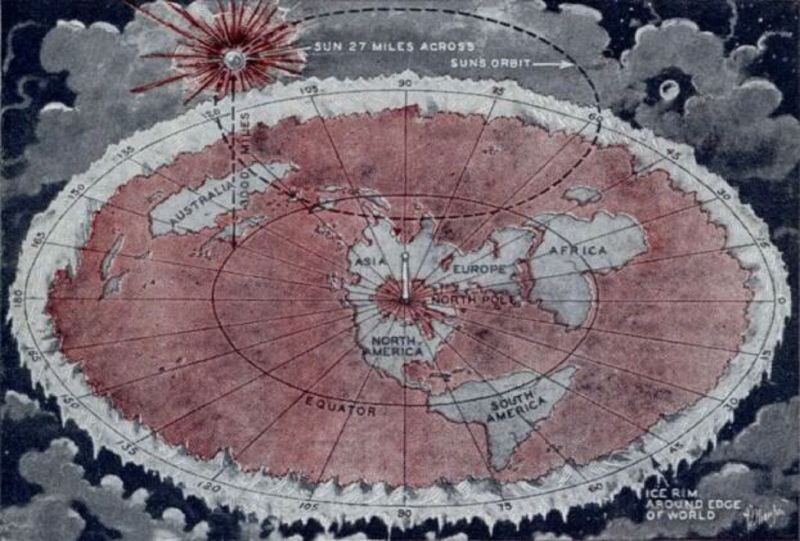

Is the sea blue?

haah! caught you instantly eh!

With that I rest my case and the topic should end right here.

Perhaps, maybe I just add a tad-bit more to spice things up.

Sunrise, sunset. Rise and set from where to where?

Look, try to convince a visually impaired person what your eyes convinced you.

I think I’ve driven the point.

Now, what about hearing? Believe all you hear? I think this’ a reduction to seeing.

What about combining see & hear? Would this instill and reinforce belief. To some it does, and to most hearing is good enough and as quickly they’d go viral with it. Don’t I know. Seriously. duh.

Gossips travel faster than SOL (speed of light?).

Light don’t travel k. Walter Russell even said, “the sunlight we feel upon our bodies is not actual light from the sun.”

Regarding Light, you don’t see the ‘light’. It’s the other way round. The ‘light’ makes you see! See? How bout that? Talk about Enlightenment 101.

Then there is ‘believing without seeing’, which means to say, “Just because you can’t see doesn’t mean it’s not there.“ Can you see the invisible gasses, energetic waves, ether, ghosts(?), and top it all G O D ?

In passing, I don’t believe in God btw—I know. Now now… don’t ask me about that! It only complicates matters (literally). Let’s just stick to belief, which is the primary status of the Collective. No malice intended. Bless and luv y’all.

The old adage ‘Nothing is as it seems’ holds firm and there’s not much surprises in this ‘hollow-graphic’ world left to excite me. I’m already bored (to death literally).

And…what about that Palestinian story (?)…oh pleeeease, for Heaven’s sake. S T O P!

Beam me up Scotty!

I believe for every drop of rain that falls

A flower grows,

I believe that somewhere in the darkest night

A candle glows,

I believe for everyone who goes astray,

Someone will come to show the way,

I believe, I believe.

I believe above the storm a smallest prayer

Will still be heard,

I believe that someone in the great somewhere

Hears every word,

Every time I hear a newborn baby cry,

Or touch a leaf, or see the sky,

Then I know why,

I believe.

..

Original post on Substack

…it’s been sometime now.

No particular reason.

Now that I am back to ‘work‘, I thought to inform you.

I thank each and every one of you for your support for the past decade/s(?)

…and your continued support is highly appreciated.

See ya on the other side.

Cheers!

..

..

Those shoes you’re wearing were likely made in a sweatshop by a child in horrendous labor conditions. That luxury handbag is a few dollars worth of leather and a fortune in deceptive advertising and branding. Those two politicians with radically different agendas are ladder-climbing friends behind the scenes, with the same corporate donors. Those big tough rappers whose beef you’re following are two poets laughing all the way to the bank. That fancy car will not only lose half its value when you drive it off the lot…but many of the cars on that same lot share the same chassis, were made in the same factories, and cost a lot less. Those songs were written by teams of songwriters, the pop star given public credit to preserve their ‘authenticity.’ That ripped actor is on steroids, that beautiful actress had plastic surgery and her images are photoshopped…and by the way, both of them are thrice married for a reason.

This list–not a conclusive one by a long shot–is not a morning dose of nihilism. It is, however, an exercise that Marcus Aurelius tried to practice in his own way. This expensive wine, he noted, was just rotten grapes. This sumptuous dish was actually a dead pig. The brilliant purple of the emperor’s cloak was dyed with shellfish blood, made by miserable slaves.

What Marcus was doing, what we can do, is “stripping things of the legend that encrusts them.” He was using the power of his mind to rip the polish off, to remove the branding, to take things down to their studs. So he could see what was really happening, that he was deceived, puffed up, tempted. Materialism, injustice, our lower urges–these things depend on legend and myth and marketing. They depend on a false picture, an inflated sense.

To act rationally, to know what matters, to do the right thing, to remain self-contained, we need to tear that down. We need to remind ourselves what things are and what they’re made of..

..

It’s a bungee jump

Relativity is a theorem formulated by Albert Einstein, which states that space and time are relative, and all motion must be relative to a frame of reference. It is a notion that states’ laws of physics are the same everywhere. This theory is simple but hard to understand

byjus.com

You are in a bungee jump lest you know it, and fully harnessed. Of course you forgot about the cord and that’s the whole point.

Even if you realized you’re entangled it doesn’t.t make the jump/s less exciting, or adventurous but more fun and joy perhaps(?)

So smile.

Life is just that. All the life dramas are your ventures of your own curiosity and boy, it sure is surreal, It has to be, How else do you experience anything?

I am making this short and sweet as I can. Time’s a changing and fast. There’s no time really (and it’s relative).

Just remember…the cord, you are SAFE and that it should give you an idea of the time and space(?)

Hope you get it.

.

In a world full of pain

And no one seems to care

I found a place

To lay my head

Where the breeze flows

through my hair

A butterfly kiss

whispering words of love

I’ve never felt

such tenderness

that made me close my eyes

and ease the pain

Warmed my heart

and brought that smile

I thought I lost it back

Back in the cold where I came from

If only you know how much I love you so

For the love that dare not speak

its name I feel you deep

within my soul

I pray, some day

I’ll be back in your arms

It’s so sad for me to go but I have to leave

Destiny calling me

I Thank you

Give you my heart

love you

God bless, good-bye

Ahron Kupner on Piano (lyrics by Merahza)

..

Joyeux noël – Selamat natal – Buon Natale – Merīkurisumasu – meli keuliseumaseu – Feliz navidad – Maligayang Pasko – Shèngdàn jié kuàilè – Frohe Weihnachten – Feliz Natal – schastlivogo Rozhdestva – krisamas kee badhaee – felicem natalem Christi – Kiṟistumas vāḻttukkaḷ – glædelig jul – Vrolijk kerstfeest – Mutlu Noeller – god Jul

m e r r y 🌲 c h r i s t m a s

and HAPPY NEW YEAR!

..

or…

No government until next election.

Is that a problem?

NO…absolutely not!

We are continually told that every country must have an activist government. No economy nor society can be allowed to just bumble along by itself, the firm smack of political control is necessary for the world to continue to turn on its axis. This is not really what the empirical evidence tells us of course. Spain has not really had a government for the past 10 months and yet it is expected to be one of the fastest-growing eurozone economies this year. And as a result the unemployment rate has just fallen to 18.9%. So much for the necessity of activist management of the economy then…

Forbes

Enough is enough…the Consti ‘ex-perts‘ and the political VULTURES should now shut up!

…what say you Blackbird?

First appeared at Cafebrain

1 hr ago

The next thing that will happen after a disastrous “election” is that the LOSERS, like the vultures that they are, will scramble and hoodwink the other pathetic losers to band {collude} together for control of the carcass (stupid voters) and the awaiting loot.

redzashahwis on Instagram

A post shared by Redza Shahwis (@redzashahwis)

The danger is that they hate each other and will DEVOUR each other while feasting on the carcass

Democracy101

The land will rot before they’re finished

…watch out blackbird!

..

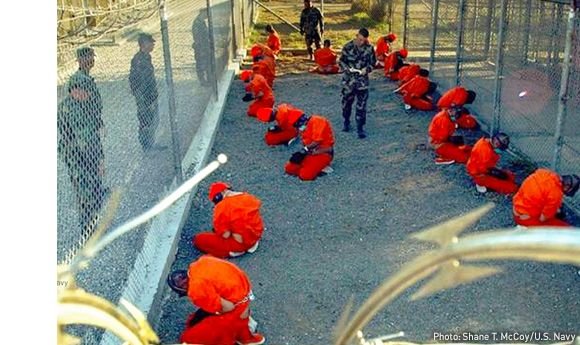

Even if I were pollinated and fully vaccinated, I would admire the unvaccinated for withstanding the greatest pressure I have ever seen, even from partners, parents, children, friends, colleagues and doctors.

People who were capable of such personality, courage and critical ability are undoubtedly the best of humanity. They are everywhere, in all ages, levels of education, states and ideas. They are of a special kind; they are the soldiers that every army of light wants to have in its ranks. They are the parents that every child wants to have and the children that every parent dreams of having. They are beings above the average of their societies, they are the essence of the people who have built all cultures and conquered horizons. They are there, next to you, they look normal, but they are superheroes.

They did what others could not, they were the tree that withstood the…

View original post 162 more words

Covenant of One Heaven

Exordium De Pronunt ionis Deus Before any higher order society, religion, or civilization existed within the star system we call the Solar System; Before the first thoughts, symbols or words were ever conceived, drawn or uttered by our higher order flesh ancestors; Before even matter itself existed, the idea of existence did exist in the form of that which we call God, the Universal, the Absolute, the ALL, the Divine Unique Collective Awareness; and As our learning as a higher order species has evolved, so has our appreciation and awe of the vastness of the world beyond our home planet when we think, write or speak of certain terms to define the ultimate creator of the Universe. We have come to learn that within a dozen light years of our star system, there exist several dozen stars. The Homo Sapien species has come to learn that just within the galaxy known as the Milky Way to which our star system belongs, there are more than one hundred billion other star systems, with many possessing planets,or planets with moons that atsome point may have or remain conducive to the propagation of life. Beyond the Milky Way Galaxy within a wider precinct called the Local Group of galaxies there are more than a dozen small galaxies and within a larger group called the Virgo Supercluster there are several dozen groups of galaxies; Beyond the Virgo Supercluster there are tens upon tens of millions of Superclusters of Galaxies within the small part of the Universe called the Mid-Inner East Planar Region which defines our place within material existence. Yet even as vast as our appreciation of the singular Universe has become, there is a unifying force vastly greater being the unifying force of all molecules, atoms, sub atomic elements, super sub atomic elements and unita elements being the Unique Collective Awareness of all existence that represents the consciousness of existence between the ultimate Dreamer as the creator and the Dream as the Universe. It is to this unifying and singular force we and our ancestors have prayed. It is this one, true and absolute Divine Creator of all Existence who bestowed in trust to all Homo Sapiens certain irrevocable rights and obligations in perpetual remembrance as trustees for all life on planet Earth. It is this one, true and extraordinary spiritual force that did give unto each and every member of the Homo Sapien species an extraordinary gift of spiritual insight far beyond the measure and normal evolutionary abilities of such a young species. Yet for all that has been given, granted and delivered unto the Homo Sapien species, its very existence and survival has remained challenged. Level 6 Life Forms of the species have been tricked into believing for many generations they are nothing more than creatures and even less value than other animals. Spiritual forces have also tricked and cursed our spiritual evolution such that even the wisest souls of the species are confounded into forgetting past life lessons and returning as ignorant as if they had carnated for the first time; and So it has been that those of the species who claim to rule for light, have acted as the worst of wolves; Those who promise hope have delivered only fear and suffering. So it is that many of the Homo Sapien species have prayed that a day will come when the deepest meaning of our existence and knowledge of ALL would be revealed; that a day would come when we would see an end to our fears, our suffering and war; that a day would come when through Divine forgiveness, the war in Heaven would end; and Thus we have waited, generation after generation, age after age for this miracle of change. Yet all the while a class of Homo Sapien civilization has remained both entrenched and sated at fulfilling its most base desires of control and willful ignorance in abusing the obligations of stewards of the planet and in causing untold hardship. Until one day, when a living Homo Sapien being remembered the extraordinary gifts given unto each and every one of the species and realized that within their mind are the powers, the ability and the authority to end all war, spiritual and physical; to end the dream of suffering and torment and to heal the spirit not only of a community, but a planet and beyond. Thus, one by one a growing number of living and deceased members of the Homo Sapien species have continued to awaken. One by one the prayers have become possibilities and the possibilities have become ideas and the ideas have manifested into form and action. Whoever has ears, let them hear; whoever has eyes, let them see; this day has come. The veil has been lifted! Death and fear has been conquered because the Divine, the One, the ALL, has made this pronouncement and Covenant known. We hereby reclaim our birthright as lawful heirs on behalf of all and their successors. Therefore, let the united spiritual forces of Heaven, Hell, all planets, all Galaxies and all matter and existence bear witness to the Divine truth of words set forth in this most sacred Covenant of all covenants. That no higher order being, living or deceased, may deny its authority, its power and validity. WE, THE ONE, THE ONLY CREATOR OF ALL,THE ALPHA AND OMEGA, THE ABSOLUTE DIVINE, THE UNIQUE COLLECTIVE AWARENESS OF ALL MEANING, TITLES AND OBJECTS, EXPRESSED INTO THE LIVING TRUST AND DREAM KNOWN AS UCADIA, ALSO KNOWN AS THE ONE TRUE UNIVERSE: with respect and compassion to the prayers and presentments by all higher order life and spirits, do hereby command through Our absolute embodiment, ownership, occupation, lawful possession and irrevocable dominion of all existence that this pronouncement be promulgated to all life, existence and spirits throughout the Universe and Heavens, including all the higher order life forms existing within the Milky Way Galaxy: Continue reading >

..

KRYON

The Biggest Shift Starting Now

Kryon – Lee US

..

[Transcript]

…it has begun

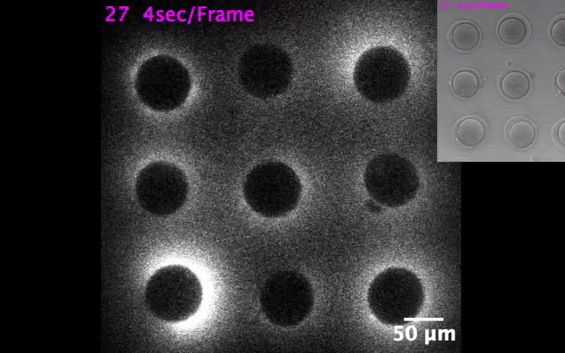

No one has any doubts that incredible and miraculous transformation of our bodies into the multidimensional six rays are taking place. We are all morphing into crystalline beings.

Since the end of 2021 the individual veil has been removed from many of us to move to the next dimension. This is a certain planetary scale algorithm for translating people to the density of the Fourth Dimension.

Over the past decades, a lot of men have been actively worked on their energy. In terms of their level of development they even exceeded Gaia. By luminosity, they became light carriers. There have always been Saints on Earth, or in modern terms–Light bearers. However, even they eventually died in their dense Three Dimensional human bodies, now co-creators in Galactic committee have launched the procedure of switching to the physical light bodies. An unprecedented evolutionary corridor has opened when the personal veil is removed from us. We are being prepared to switch to another corpus. After removing the veil, our biology begins to transform through the steps of the Fourth Dimension. At the cellular level higher potential energies are fed into our body, and their vibes in the truest sense of the word, shake our cells. Our organic matter vibrates at new frequencies, gets used to it and at a certain moment accumulates a critical notch after which the Phryg scales switches one octave higher.

There is a change of wiring in our body. The movement of atoms and molecules in our cells is activated at such a high rate which our body can already cope with at this stage without harm to itself. So we step on to the first stage of the Fourth Dimension.

For a while we adapt. Integrate a new type of energy exchange into our physical life. Then the cells begin to supply the next highest frequency. It will continue until we completely enter 4D. During mutation many issues concerning our health become non-working and therefore irrelevant. The new 4D/5D matter has other physical qualities.

In the next dimension different laws work. This is especially true for the analysis of the causes and consequences of hereditary diseases, birth injuries, karmic drag and so on. If we sort it all out now looking for their origins, it’s like clinging to the last century. We all have a family inheritance. Sometimes and maybe often, it is not in our favour. Now we have the right to simply cancel all these, break contracts and choose other options for our future. Today it is already of no importance. There are people among us who are switched in advance into the intermediate phase of the light body the so called transition body of silicon. When moving even into the initial level of the Fourth Density, genetic differences become more noticeable and pronounced.

Over the years, not all Earthlings have been transferred to the silicon body, but only those who consciously participated in the redistribution of space-high frequencies to Earth. Now their corpus’ very high energy combat activity and resistance to radiation. But, even they find it difficult to hold the pressure of high frequency energies from the Fifth Dimension. Today the next stage of the transition is accelerating which will not spare anyone. This is the transformation not into silicon. There is no time for that, but completely into light bodies. At the moment, it is desirable that we have more or less a physically trained corpus and accustomed to loads. A very high energy potential is being loaded into us. Our body is experiencing stress. People who do sports have such an opportunity, or habits, or culture at the time of transition such a lifestyle can be very helpful.

There is an effective tool to raise our frequencies through a conscious connection with the Source with our spirit. The Light enters Earth. the Creator is coming. It doesn’t matter what happened yesterday wether in our family, in the State, and in the world in general. Now it is more important for us a new type of thinking in relationship with ourselves through mindfulness meditation and stopping our mind ego. This way we will help our body get rid of diseases faster. Even without the psychosomatic so loved by the Disclosure News Italia contributors. That is why many do not practice healing in energy cleansing.

Without a change of mindset it is ineffective.

The great transmutation of matter is already in irreversible physical and physiological process going on in the cells of our body at the molecular level. The reformation will be accompanied by the birth of new organs with previously unprecedented vital functions including the capacity to interact directly with the energies of Earth and the greater Cosmos. We live in a timeline in which people perceive the material world with its absurd scenario passing by their eyes and ears invisible energy processes affecting the nature and conscious and unconscious people on Earth

Starting from December Twenty First 2021 until the Vernal Equinox of March Twentieth to Twenty First 2022, those who have switched to 4D will be tuned with the high vibration frequency field of the Fourth density.

At the beginning of March 2022 the high vibes Fourth Dimension has already spread to 56 percent.

By the Autumnal Equinox, which in 2022 will occur on September 23, it will reach as forecasted 98 percent and by mid-November will be fully stabilized. After the Autumnal equinox of 2022, the 3D and 4D layers will be separated from each other by 100 percent different vibrational fields. The scenario vectors of the 3D and 4D matrices will begin to live a parallel life in their individual realities. With each passing day the intersections of destructive and constructive Karmic program between the minds of people of the Third and Fourth dimensions will be finally separated.

Before switching to 4D each of us needs to go through all the necessary tuning and transformation of our body. Raise the vibes of our bio field and consciousness to this level. Modern society demonstrates the complete absence of any immunity and the material and spiritual development.

From the moment of the Autumnal Equinox this process will accelerate and will lead to the separation of all the people of Earth by vibrational fields. Humanity has already been divided into two opposite camps. Choosing the path to light and going into darkness. Men who have chosen their option clearly different freak soul purity and awareness level. A person living by the values of material society often unconsciously chooses the path leading to the destruction of his Soul. Many conscious 3D people living in large cities are increasingly experiencing spiritual discomfort and are trying to escape from the metropolis and move to the suburbs or villages. They are driven to such a step by an explicable feelings and desires which they themselves cannot fully understand due to the low vibration of their cell bodies. Many of them try not to watch TV news but they are still immersed in 3D in their personal inner world. Life in a stone metropolis really nearly forces us to connect to the egregious fields, thereby unconsciously submitting to public opinions and values imposed by the ignorant population. This destructive scenario when you’re accessing 3D Matrix so we don’t have enough energy for our spiritual and moral development.

From the moment of the Spring Equinox to the Summer Solstice depending on the individual vibrational development of the settled bodies, the vector of future events of life will be determined for each of us. Conscious people will have a final transformation of their physical body. The values of material life will be of secondary importance. At the same time emotional difficulties will arise due to a small number of 3D files and material thinking algorithms. But gradually the center will shift to the spiritual world and by the Autumnal Equinox September Twenty Third 2022 it will reach a stable balance and a consciousness of a renewed Man of the New World. For the first time most 4D people wil be able to perceive the spaces of the Fourth Dimension in full. It cannot be said about those who remain in 3D who will plunge headlong into working out Karmic programs which will be reflected in the relationships between relatives, neighbors, and friends. For every 4D person the narrow thinking of 3D inhabitants will cause rejection, unwillingness to maintain close contact in previous communication.

Life on Earth will be blessed when city men consciously turn to nature because only there they stay in comprehensive energy contact with the Absolute and only their life becomes real and helps the tuning for their transition to 4D.

⛎

| 🇷🇪🇩🇿🇦 𝙎𝙝𝙖𝙝𝙬𝙞𝙨38 min ago |

This is not a day for remembering violence, but for memorializing your decision to heal every wound that could cause it.

There is one question that no one will ask of those who use violence and pain to make their point:

What hurts you so bad that you feel you have to hurt me in order to heal it?

This does not condone violence, but it can help to understand it.

“No one does anything inappropriate, given their model of the world.”

Embracing the wisdom in those eleven words could change the course of human history.

Pushing and kicking doesn’t work. Trust me.

Resistance leads to persistance.

The counter-intuitive way (the only way unfortunately)

Overlook. Embrace it.

Check-point:

Next…smile (as w i d e as you can)

Because…

What matters don’t mind, what minds don’t matter

No BS

I promise.

– The Scarman

(The homeless with a house)

..

First appeared at Substack

| 🇷🇪🇩🇿🇦 𝙎𝙝𝙖𝙝𝙬𝙞𝙨1 hr ago |

I am the only son. The only boy in the family. The only one with balls if I may say so

Don’t have that many friends but many acquaintances though.

There’s this one bloke whom I’ve known for decades. He is all — an acquaintance, a friend, a buddy, a brother and a pain in the ass.

That’s how special he is.

We disagreed on many many things and we agreed on many too, you know like that wine, women and song stuff(?)

In a relationship its great to hate the same things 😉 If it takes fighting a war for us to meet, it will have been worth it.

We have a common enemy and we fought many battles together.

Some things needed saying. He’s (too) generous and tend to go against the book. BTW and for the record, we’ve fed the needy in the early morning hours.

Let me tell you, he’s done his job.

Now he is diagnosed with that bloody capital C thingy and the ungodly medicine men gave him a couple of months to remain on the plane(t)?

I ran to see him. We hugged and tears rolled down my cheeks (and his too).

It was kinda sad but it was a GREAT DAY. It was.

I made a date to have a cuppa of pulled-tea with him for the Thirteenth September 2022. Told his son to put it down on the diary.

Hey… we, you and I decide the what and when of our lives.

Kapish?

First published on Substack

:

:

Apr 16

Into The NewNot forgetting the old

© 2022 🇷🇪🇩🇿🇦 𝙎𝙝𝙖𝙝𝙬𝙞𝙨

Privacy ∙ Terms ∙ Collection notice

Substack is the home for great writing

Who will be valiant for justice sake

Our future was stolen from us...by men artfully protecting their own interest, selling their souls, enslaving their fellowmen for their own gain in this world with no thoughts to the next.

There are many who are called to break this curse.

Watch The Called – Makings For A Perfect Day

Visit The Jenniffer Mac

17.107

..

i spent the afternoons of this weekend dangling from my climbing rope over the edge of our 155 foot bluff overlooking the beach and the ocean. i was trimming bushes as well as the tops of a few cedar and spruce trees of over one hundred feet in height. The view was interesting. Seeing straight down a tree is unlike any other view of it. The twisting nature of life as an evergreen is visible in the view from above.

It was a filtered sunny day both afternoons with the chemtrails having layered up into a general haze about mid morning. Peering upside down through the tree boughs and brushy bits of shrubs, even though the light was filtered, it was still possible to see the ‘phase shift’ of the light being affected by the branches within my vision. The capacity to view subtle light phase shifts is best cultivated as a side effect of zazen, or ‘sitting’ meditation. It involves conscious focus of one’s awareness within the vision perception of the cardinal points within the eye that provide the peripheral view of life. As the human eye has more of its sensors devoted to discerning green than any or all other colors, perception of light phase shifts are easiest to see in green.

It is exactly this phase shift in light that J. R. Boscovich notes in his De Luminae as a ‘guide’ for animals as to their location. The contention is that birds, and other migrating animals including aquatic species, navigate via paths framed by specific aspects of light. Many of these animals likely are also green centered in their light perceptions.

i could perceive some of the shifts of light in the green haze around my head produced by sunlight working inward through the dense canopy of cedar & spruce needles in which i dangled and worked. There were subtle differences in shade and phase dominance where the blue-green of the spruce was in the majority.

As each day’s work took several hours, i had occasion to note the response of the trees to the clean up of dead material & shading branches. All of the plants were reacting in real time to the changes in light intensity & phase as i altered the shape of the canopy. Increases of intensity of light provoked reactions in branches & needles to shift positions which in turned caused other leaves and plants to react to those shifts. Light now penetrated through the dense canopy to the base of the trees below initiating new activity in ground covers gripping tightly to the sheer face of the bluff.

Not only plants reacted. From my perch among the branches more frequently gripped by eagle claws than my gloved hands, i could peer way down the length of the trunk to see new activity among the insect dominated biota. New light produced exploration, and seeking for growth in all of the biota exposed.

Our current emotional frappe of plandemic is also having the effect of pruning dead and shading branches with the expected effect of stimulating new growth in unexpected, and long neglected areas. i will delve & dwell on these topics repeatedly as we push forward into the SciFi world that is sharply emerging from the smelly remains of the SARS-COV2 infected corpse of the former globalista financially structured and dominated world. The phase shift of the pruning now manifesting is already producing stimulating effects visible within the turning and shifting of the big branches at the top of the economic tree. More growth, more shifting, more exploration, of a longer lasting nature bursts into sight and comprehension as the mass of the economic biota, the populace of working entrepreneurs around the planet, respond to these sudden new intensity and phases of the light flooding into their vision.

As a cyclist, in many forms of that word, i find it gratifying that the timing of humanity moving into both Year Zero and SciFi World was so clearly marked for history. It is as though Universe provided a giant slap upside the head while slamming shut the perceptual sense of continuity with our past, as individuals, and as collective humanity with a unique global event. Yes, there had been pandemics, but never before, owing to our global satellite system and the internet, have we had a real time awareness of a single episode affecting all of our species. Even the very nature of pandemics have phase shifted in this new year, decade, and reality.

As Time drags humanity, sleeping & stumbling, into Year Zero, across the threshold of the Age of Aquarius, the only astrology sign symbolized by a man, and the only one focused on an intellectual abstraction, ‘Knowledge’, greets us all as several major cycles of many thousands of years completed.

It is in the area of knowledge that our world is changing most. It happened the very day that you became aware of the plandemic. Since that moment, the changes have been piling up with no sign of reduction of either speed or volume of shit heading towards your mental and emotional stability barriers.

Read more…

halfpasthuman.com

..

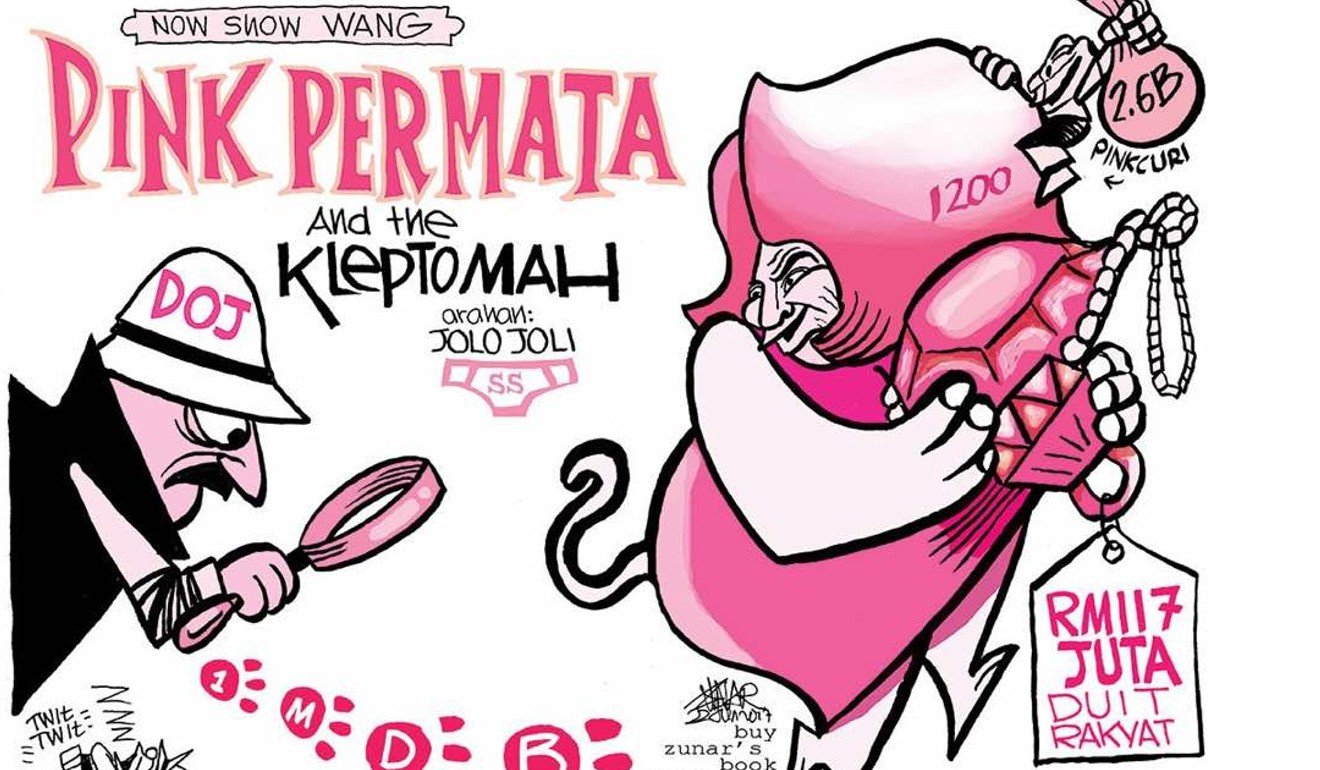

On May 9, 2018 Malaysians went to the polls, and the voters got what they wanted – a tsunami. A Crime Minister who bankrupted the nation fell disgracefully along with his UMNO, the corrupt political party, which literally short-changed and killed the very people it was championing. We’ll not delve into the damning details of this whole political galore and instead just look at the chronology of the BIG SALE.

Joy and hope was restored and the earth moved under Malaysians feet.

What the people did not realize and expected then, is that they were in a BIG Government CLEARANCE SALE. — ONE vote for THREE Crime Ministers/Governments!

The SALE went through a series of a distasteful Sale & Marketing program namely:

For the next two and a half years Malaysians were on cloud nine and the country looked like it was going places on to a bright future of sort. History was created when Mahathir became Crime Minister for the second time and more historic was that a government, comprised of UMNO‘s nemesis namely the DAP. The people were in ecstasy from steroids overdosed.

On February 24, 2020, the first Crime Minister Mahathir resigned. Apparently, it was brought about by a program named The Sheraton Move, led by non-other than his protege Azmin Ali and the wannabe soon to be Crime minister Muhyuddin Yassin. From that emerged the inglorious BACK-DOOR Government.

Muhyuddin Yassin took over as planned as the second Crime Minister and the dreaded fallen UMNO came back into the power scene. Claiming to be the 8th prime minister? Was the Sheraton Move the GE15 absent of voters?

Anyway, let’s leave it at that as what pursued was more unexpected(?), not only for Malaysians but the whole surface population of Earth.

The second Crime Minister’s hands were to be filled with what no Prime Minister in the whole world ever got in the history of modern corrupt politics – The Plandemic. Being a man with high IQ (Idiot Quotient) he was stripped off his boxers and under great pressure relented and passed the baton to his “selected” victim.

A third Crime Minister, a relatively unknown Ismail Sabri accepted the baton and put UMNO back in power and try to finish the relay run. This guy has a higher IQ (idiot quotient) than his predecessor. This is very apparent by the very fact that he accepted.

Is that the end of the GE14 misadventures?

Well, that depends with what will happen in Arizona soon.

Meanwhile, Malaysians are basking in their good fortunes amidst the lockdown

…what a fucking lucky lot!

..

The timeless wisdom of C.S. Lewis This is as good of a share as any to those in your life who have found themselves negatively influenced by the “virus” narrative:

This is the first point to be made: and the first action to be taken is to pull ourselves together. If we are all going to be destroyed by a “virus”, let that virus when it comes find us doing sensible and human things–praying, working, teaching, listening to music, bathing the children, playing tennis, chatting to our friends over a pint and a game of darts–not lockdowned together like frightened sheep and thinking about covid and vaccines. They may break our bodies, but they need not dominate our minds.

Rephrasing C.S Lewis, 🌿 [On Living In An Atomic Age 1948]

| On Living In An Atomic Age 1948 ‘“How are we to live in an atomic age?” I am tempted to reply: Why, as you would have lived in the sixteenth century when the plague visited London almost every year, or as you would have lived in a Viking age when raiders from Scandinavia might land and cut your throat any night; or indeed, as you are already living in an age of cancer, an age of syphilis, an age of paralysis. an age of air raids, an age of railway accidents, an age of motor accidents.’ In other words, do not let us begin by exaggerating the novelty of our situation. Believe me, dear sir or madam, you and all whom you love were already sentenced to death before the atomic was invented; and quite a high percentage of us were going to die in unpleasant ways. This is the first point to be made: and the first action to be taken is to pull ourselves together. If we are all going to be destroyed by an atomic bomb, let that bomb when it comes find us doing sensible and human things–praying, working, teaching, listening to music, bathing the children, playing tennis, chatting to our friends over a pint and a game of darts–not huddled together like frightened sheep and thinking about bombs. They may break our bodies (a microbe can do that) but they need not dominate our minds.” C.S Lewis, 1948 🌿 |

I don’t subscribe to narratives and memes which are spells put on the masses as a form of thought forming to lead them to destruction.

Political correctness are killing the people and if not immediately put to a halt, there will be no one else left on the surface of the Earth.

What’s going on in Malaysia is a massacre by eugenicists disguised as the govern–ment with a tool softer than cotton and in fact invisible – it’s called VIRUS.

The word virus is spewed by every man, woman and child 24/7 and what’s sickening is NO ONE knows what it is. Google, or better Duckduck Go “virology” if you want to know.

There is a war literally going on for your mind. Truth is stranger than fiction. The people have been doped with FEAR that they don’t realized that they ironically chose suicide to avoid death by an “infection” from a non-existent Digital Delusion “bug“

The corrupt govern-ment have collapsed. The Parliament is re-closed after it barely opened, and all because of a fucking bug.

The domain of the “virus” and is viral on the cyber space – on their fucking smartphones.They spread it on SOCIAL MEDIA amongst their idiotic selves and got “infected“.

That’s the PLANDEMIC for you my dear people.

What the enemy is doing is to depopulate the Earth by injecting poisons into the people and daily one by one is dropping dead throughout the world.

IT IS A MASSACRE

“On a long enough timeline, the survival rate for everyone drops to zero.”

― Chuck Palahniuk,

..

!! UPDATES ongoing from time to time…

As the title suggests and more precisely, it is the Saturday the Governments of the world shook.

The people of the world rose to tell the powers-that-be (PTB) that ENOUGH IS ENOUGH!

From down-under Australia all across to South Africa, about a hundred cities erupted in protests against the Plandemic Scam which frozen the lives of the people for about 18 months.

Saturday is ‘Thaw’ Day and as the heat built up, the ice melted and the people shout, “NO MORE LOCKDOWNS”.

Like wildfire the protests spread from Sydney, Tokyo, Athens, Rome, Paris, Helsinki, London and Cape Town.

Interestingly as numerology has it, it is the day of 666.

Saturday (6) 24(6) July(7) 2021 — 6 + 6 + 7 + 2 + 2 + 1 = 24 = 6

The Day the Beast meets its reckoning?

More protests are spreading in other cities at the time of writing, and I will update as I get more reports in.

..

The End Times that we’re in now is in my observation, reversing to WWI scenario of deaths and destruction estimated 8.5 million combatant deaths and 13 million civilian deaths as a direct result of the war, while resulting genocides and the related 1918 Spanish flu pandemic caused another 17–100 million deaths worldwide.

The political/financial OBSERVERS and ANALYSTS are reporting the “faults” of the SYSTEM and the wrongdoings and mistakes of the players and stewards.

All of the above put together made it most certain of the greatest catastrophe to befall mankind.

Almost if not all of the experts are blind to the fact:

THE SYSTEM WAS DESIGNED TO COLLAPSE

ENTROPIC SYSTEM IN A ORGANIC ENTROPIC WORLD

…entropy and inertia combined is a classically perfect Runaway Train 🚂🚃🚃🚃…….

…so, those who’re looking and hoping for a recovery are in for a shock and despair causing their own demise.

Is it the END OF THE WORLD?

…it is the end of the world as we knew it

Harsh as it may be, REALITY is at its peak REAL-TIME.

As blind as the experts, we the people are as blind

…it is our fault!

The end is nigh..

May the road you choose be the right one.

..

David Sörensen

StopWorldControl.com

Amazingly powerful vision about the end of evil

Try to listen to this beautiful and hope giving message with an intelligent and open heart.

Reject all foolish negativity that is never helpful, reject silly pride and hate, and open your heart to hear what amazing hope there is for all of us.

This vision shows where we are at, in the battle against the worldwide network of criminals that have caused the pandemic, and are planning to submit the whole world to their diabolical control.

If you can grasp the significance of this message, it will remove all depression, fear and anxiety, and fill you with strength, courage and hope for the future.

David Sörensen

StopWorldControl.com

Andreas Kalcker is collaborating with thousands of scientists, medical doctors and lawyers, to prepare tribunals for all who are complicit of this genocide. He is supported by the military in many nations, who refuse to surrender their nations to the New World Order.

Watch the Video >

https://rumble.com/vfk52n-a-miracle-cure-for-covid-scientists-against-the-new-world-order.html

This cure wipes out COVID-19. Why is it hidden from the world?

The biophysicist Andreas Kalcker brought the COVID-19 death rate down from more than a hundred deaths a day, to basically zero, in several nations. Now more than 4,000 medical doctors are using his treatment, in dozens of countries.

stopworldcontrol.com

Sign up and learn how to defend yourself.

Visit Stop World Control

COVID19 A PLANNED PANDEMIC AND A CRIME AGAINST HUMANITY

1 Introduction

As it has emerged from doctor Scott Jensen’s, the doctors had the death certificate changed, as

explained in this video.

• Video nr 1: The numbers do not match

• Video nr 2; Doctor demands/audit of covid deaths

That is: From the registered infection on day one up to and including day 30, “Covid associated” is entered on the death certificate, regardless of whether it is Covid or something else that is the cause of death. On FHI’s pages, it is contradictory that in the event of another known cause of death, Covid falls away, but it will still be carried out based on a positive test.

The FHI’s pages also show that not all tests are laboratory tests confirmed.

Regards on a global scale. Here is how FHI informs about the notification and notification lines.

FHI considers influenza and other colds that fall under the newly created covid code as a diagnosis but does not differentiate the figures below the code. See doctor Scott Jensen’s in conversation with Tall Knekkeren, who has made the reporting solution that is used. Here it is shown in this video that the flu was “eradicated globally.

Watch film how the numbers are reported in the system.

• The numbers aren't adding up - this will shock you

• Part 1: Tribute to Dr. Scott Jensens

• Part 2: Tribute to Dr. Scott Jensens

Every awaking person understands that this is not a reality. The introduction of a covid code phasing out of the flu code that we refer to her shows at the national level how this could happen. By changing the code registration both at the diagnosis level and in the event of death registration, we place significant doubt that this has been done with other purposes.

The virus has not been isolated. We have yet found information that the virus has been isolated.

We believe that the intention is to create a “legitimacy” for the “alleged” pandemic. The numbers tell their own language. Without dignity, Norwegian authorities take part in such a narrative towards the Norwegian population and are involved in global influence.

Please note this information has been spread nationally, and everyone who contributes to this

deception risks being prosecuted for a severe crime in the worst-case genocide.

Read or > download the full report

or download PDF here:

This is a comprehensive overview of the hidden agendas behind the alleged COVID-19 pandemic. It is a presentation by Lee Merritt, MD, at the 2020 conference of Doctors for Disaster Preparedness. If you have any doubts about the reliability of the official narrative of COVID-19, the facts presented here will, unfortunately, confirm your suspicions. This presentation was prepared for doctors on the front line of dealing with the consequences of a make-believe pandemic – medical professionals who know that what Dr. Merritt says is true. Those who know about COVID-19 only from news reports, government officials, and tycoons planning to make billions from mandatory vaccines will not be familiar with this information. 2010 Aug 6 – Source: Charles Ritter

View original posting at Red Pill University

There’s nothing social about forced isolation…

“The truth is not for all men but only for those who seek it.”

― Ayn Rand

..

by Jeffrey A. Tucker

American Institute for Economic Research.

In my lifetime, there was another deadly flu epidemic in the United States. The flu spread from Hong Kong to the United States, arriving December 1968 and peaking a year later. It ultimately killed 100,000 people in the U.S., mostly over the age of 65, and one million worldwide.

Lifespan in the US in those days was 70 whereas it is 78 today. Population was 200 million as compared with 328 million today. It was also a healthier population with low obesity. If it would be possible to extrapolate the death data based on population and demographics, we might be looking at a quarter million deaths today from this virus. So in terms of lethality, it was as deadly and scary as COVID-19 if not more so, though we shall have to wait to see.

“In 1968,” says Nathaniel L. Moir in National Interest, “the H3N2 pandemic killed more individuals in the U.S. than the combined total number of American fatalities during both the Vietnam and Korean Wars.”

And this happened in the lifetimes of every American over 52 years of age.

I was 5 years old and have no memory of this at all. My mother vaguely remembers being careful and washing surfaces, and encouraging her mom and dad to be careful. Otherwise, it’s mostly forgotten today. Why is that?

Nothing closed. Schools stayed open. All businesses did too. You could go to the movies. You could go to bars and restaurants. John Fund has a friend who reports having attended a Grateful Dead concert. In fact, people have no memory or awareness that the famous Woodstock concert of August 1969 – planned in January during the worse period of death – actually occurred during a deadly American flu pandemic that only peaked globally six months later. There was no thought given to the virus which, like ours today, was dangerous mainly for a non-concert-going demographic.

Stock markets didn’t crash. Congress passed no legislation. The Federal Reserve did nothing. Not a single governor acted to enforce social distancing, curve flattening (even though hundreds of thousands of people were hospitalized), or banning of crowds. No mothers were arrested for taking their kids to other homes. No surfers were arrested. No daycares were shut even though there were more infant deaths with this virus than the one we are experiencing now. There were no suicides, no unemployment, no drug overdoses.

Media covered the pandemic but it never became a big issue.

Read more at AIER

By now, having going through the contrived lockdown, people should have become more aware and be more wary of tyrants with their high ambitions to control the world. To control YOU.

I’ve done my homework long enough to discern what is and what is not being presented to the world, especially to me.

The lockdown due to Covid19 is ongoing and god knows for how long.

There are mountains of reports and articles about the virus from both side of the divide to satisfy both parties. I for one is on the side that questions everything. Personally I am clear about what’s going on in this world and it’s not pretty I tell you. In fact, I am in dangerous times and my liberty is at stake.

The lockdown is and of itself a serious breach of my fundamental rights, regardless of the exigency it was imposed upon.

Obviously, WHO (is behind the lockdown) an agency of the United Nations is inept of its own Universal Declaration of Human Rights

The employment of government power to assault personal liberty and cut constitutional corners is never justified in a free society, no matter the exigency. The Constitution protects our rights in good times and in bad. Those in power who steal freedom are unworthy of office. But don’t expect them to give us our freedoms back. We will need to pry it away from their cold and covetous hands. – Judge Andrew P. Napolitano

Consequently, saving additional COVID victims today with a particular policy may result in even more avoidable deaths in the future. If that is the case, such a policy will result in more people dying, and “we’re not going to put a dollar figure on human life” has nothing to do with it. – Misses Institute

Okay, let’s dump all the rules aside. Let’s see wtf this covid lockdown is all about.

This video was sent to me by Dr Stuart Bramhall and it is (to me) the answer to my question.

As you can see they, WHO, YouTube and gang pulled it dowN!!

I was fortunate to view and listen to the video and made notes before they tore it down.

This link is still on at the time of writing. Watch it now before they block it (again)

The most profound message from Drs. Dan Erickson and Artin Massihi, co-owners of a chain of Accelerated Urgent Care facilities, is the Secondary Impacts of the lockdown, which is more devastating than Covid19 itself.

Do I need to paint the grisly picture?

If you can’t visualize it, I recommend you watch any movie on the aftermath of a nuclear bomb attack. Or watch these photos at BuzzFeed

They are murdering you while you’re comfortably in your homes shoving pop corns down your throats watching NETFLIX!

PEOPLE MUST RISE NOW AND STOP THIS GENOCIDE!

..

“Do you begin to see, then, what kind of world we are creating? It is the exact opposite of the stupid hedonistic Utopias that the old reformers imagined. A world of fear and treachery and torment, a world of trampling and being trampled upon, a world which will grow not less but more merciless as it refines itself. Progress in our world will be progress toward more pain.”

~ George Orwell (1961). “1984”

I just read a rather intimidating article Do you speak corona? A guide to covid-19 slang by the illustrious Economist about new slang that emerged in this coronavirus (r)age. It will definitely amuse the Coronajustice Warriors, who are their main audience. They are prepping up their warriors for a battle against those who don’t buy the Plandemic hoax, whom they’ve labeled as Covidiots.

Around the world, coronavirus is changing how we speak. Don’t be a “covidiot” – make sure your pandemic parlance is up to scratch.

Here’s what I say to that.

There’s a new religion brewing as we speak and I called it COVIDISM. The devotees are the coronajustice warriors and they are called COVIDISTS.

I’m not into religion and I have nothing against people who are religious. People are free and have the right to their choice of beliefs as entrenched in the Constitutions of most countries. What I’m against is the imposition of beliefs on others. That’s not only unconstitutional but abominable.

The Covid19 event is about herding the people into forced Covidism. The current lockdown is the indoctrination and familiarization period to practice the prescribed rituals. It will be extended accordingly until they’re satisfied with your performance, and oh, until your original faith is ‘softly’ eroded. When was the last time you went to church, or mosque or temple?

That list is just the beginning, the main precepts if you like. There’s more to come of course. They will make it up as they go along. This religion is to dehumanize and self-centering the people. Its oxymoronic. Stay away from others because you care about them getting infected by you. The “virus” will be around for a long time to come. The High Priests will dictate your daily life routine, even on what to eat and drink. All organic foods including meat and your old favorite junk foods (of course), shall be removed from the face of the Earth to be replaced with synthetics manufactured in their factories.

Death is inevitable, so never hide from life, and never allow a moment of life to be taken from you by tyrants. All government is tyrannical, and all government seeks power and control, and today it is using a purposely-created crisis in order to gain that control. We are being told by false rulers to abandon our lives, and hide away from those we care about in order to stop a virus. This is the highest form of deception, and is only meant to divide us so sinister agendas can be accomplished in the shadows.

While you still have your freewill and freedom of choice (whatever is left), know that it doesn’t include the hurting of others. Be stupid and hurt yourself if that’s your choice. Nobody should stop you. Don’t hurt others. Don’t hurt me.

Believe anything you want, believe that you’ll be infected by a ‘virus’ and that you’ll die from it if it doesn’t pain your loved ones and the people around you.

Embrace Covidism if you choose to, but keep it to yourself and stay away far far from me.

…and don’t tread on me.

Original posting at Steemit

..

.

Humans are social beings and that is the way of Creation to place us on Earth touching and mingling with each other in this life. Take that social element away from the equation and life is hell.

People shall overcome the evil schemes of the psychotic Slave Lords. By God, we will.

Meantime in the lockdown the apparent (unseen) danger is the “getting-used-to-it” as it is being extended gradually by design. Alongside the FEAR porn of the fake virus, comes the indoctrination in the guise of motivation and Dutch comforts.

“We’re all in this together”?

NO, Were not all in this together!

The notion that “we are going to get through this together” seems to be based in the assumption that the crisis is going to move quickly, and if we hold tight, our sacrifice will be minimal and all will go back to the way things were before. This is simply not so.

There is a gush of articles online, while some are well-meaning, most are psycho-designed to calm and tame tensed-up and distressed people who are going bonkers trapped indoors in their homes for the first time in their lives.

Amongst the literature disseminated on the Internet are writings to help people cope with the House Arrest. Some are good, especially educational stuff covering various interesting subjects of (new) learning to many. Most are craps especially ones on the faux positive thinking motivational stuff.

Learn by all means and take this opportunity to do so, instead of just binging on food, drinking, and smoking expanding your bodies sideways.

Learn from this moment on that you shall not stop learning in freedom.

It will be to your own detriment when you’re finally released from the House Arrest as a phobic, trained anti-social being, and worst (if not) a miserable misanthrope.

Remind yourSelf that you are under HOUSE ARREST.

“Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety.” — Benjamin Franklin (1706-1790)

YES, you have undoubtedly lots of free time, but you ARE NOT FREE.

..

Original posting at Steemit

How could it be possible or imaginable that 7 billion people could be controlled by a few (a thousand at most) psychopathic ⁉️

For how long will the virus hoax and/or their techy mind-control tools/devices last before the people get wiser, wake up and rise?

Its a very ambitious scheme, but a daunting task nevertheless to hold that many people in subjugation for long.

Their evil plan is not without resistance from the people, definitely not I assure you, and that itself presents a insurmountable problem for any would be slave lords.

Never underestimate the power of We The People

They will fail.

Amen

Original posting at Steemit

..

In Malaysia we’re now in the 34th Day of The Plandemic Lockdown

People are now like the Frog In The Boiling Water

Most seem to be getting used to the “extended vacation” if not enjoying it specially those with paychecks still being remitted into their bank accounts.

While “indoor” they’re completely oblivious to what’s happening outside their boiling pot.

The lockdown will run until the total collapse of the people’s wealth. The architects of the Plandemic have plans of course, for them. We’ll leave that subject for a later time.

Back to the frog (people) in the boiling pot, they’re being kept preoccupied with THE VIRUS. They’re being bombarded with tons of horrid STORIES and statistics of the virus, and grandmother’s health care articles and news.

Many care-a-less of the economic demolition going on since the lockdown and the impending impacts on them.

What’s frightening is that they aren’t frightened about the financial and economic collapse because that’s not a possibility at all to them as the water in the pot warms up and they’re getting to get used to each increase of degree of the heat and everything is reasonably fine at “home”. Food is on the table at every eating time for the past month or so.

The devils are dishing out Dutch comfort phrases like “Don’t worry. Be calm. We’re in this together. It will be over soon!”

Right, it will be over and there’s no doubt about that. What’s missing in that is the real BIG picture of the Plandemic aftermath.

Here are the harsh hard facts for you to picture it yourself.

..

Shutting down the economy is unleashing a Great Depression far WORSE than that of the 1930s. Our political leaders are absolute morons. This has demonstrated that they have no common sense and the abuse they have inflicted upon society for the political benefits is just mindboggling. There is NO HOPE IN HELL that the economy will recover. We are looking at a crash and burn into 2022. All the headstrong people talking about hyperinflation and the dollar will crash who lost a fortune on the way down since January, are going to lose everything between now and 2022. They remain absolutely clueless as to even what capital formation is all about. – Armstrong Economics

I stand corrected and I’d be very happy to be wrong.

Mental preparedness is your best bet to survive in that gloomy scenario.

YES. Do remain calm, but prepare for the worst is yet to come.

Original posting at Steemit

..

Every one has the freewill to decide to do what is right for one-self without doing any harm to another.

It is the right of each to be as he/she wishes including to be filthy, un-hygienic, stupid and/or fearful.

Be responsible. Not many comprehend this word, and that is not doing them or others any good.

It’s not my duty to teach any one and it surely isn’t my problem.

I am experiencing virus fatigue by the ongoing nonsense and surrounded by those who jump onto the FEAR wagon and ended becoming frightened of their own shadows. I offer no sympathy nor any advice for them.

But I state here for mySelf:

I AM a social being and I AM free to socialize with those who chose to do so with me and I SHALL NOT distance mySelf from any of them, even if they are not in their best of health.

I AM hygienic and shall maintain as such for no other reason than to be clean and healthy.

….think for yourself

Original posting at Steemit

April 16, 2020

Enough is enough.

The employment of government power to assault personal liberty and cut constitutional corners is never justified in a free society, no matter the exigency. The Constitution protects our rights in good times and in bad. Those in power who steal freedom are unworthy of office. But don’t expect them to give us our freedoms back. We will need to pry it away from their cold and covetous hands.

During the past month, as Americans have been terrified of the coronavirus, another demon has been lurking ready to pounce. It is a demon of our own creation. It is the now amply manifested inability of elected officials to resist the temptation of totalitarianism. And it is slowly bringing about the death of personal liberty in our once free society.

It is one thing for public officials to use a bully pulpit to educate and even intimidate the populace into a prudent awareness of basic sanitary behaviors — even those which go against our nature — to impede the spread of the virus. It is quite another to contend that their suggestions and intimidations and guidelines somehow have the force of the law behind them.

They don’t.

The government in America — at both the federal and state levels — is divided into three branches: legislative, executive and judicial. This separation of powers was crafted at the Constitutional Convention in 1787 after heated debate. The essence of the debate was this: how to establish a government strong enough to protect individual liberty but not so strong as to enable the government to destroy it. James Madison and his colleagues devised the separation of powers to keep power from accumulating in one branch.

The legislative branch writes the laws, and the executive enforces them, and the judiciary interprets them and articulates what they mean. The president cannot write laws. The courts cannot enforce them. And Congress cannot interpret them. When Congress has gotten lazy or presidents have gotten ambitious and we’ve seen presidential lawmaking, the courts have struck it down. Stated differently, the separation of powers is core to our freedoms and the courts have consistently ruled that core functions assigned by the Constitution to each branch cannot be ceded away to another branch.

The same is the case for the states, as each state’s constitution mimics the U.S. Constitution and mandates separation. The separation is not mandated to protect the prerogatives of each branch. It is mandated to protect individual liberty by preventing any branch from accumulating power assigned to the others.

This has been Madison’s genius. It has become Madison’s sorrow.

These “orders” — stay at home, close your business, don’t run in the park, don’t go to Mass, practice social distancing — are not laws that can carry a criminal penalty for violation. They are guidelines, without the force of law. A governor or mayor can no more craft a law and assign a punishment for its noncompliance than the courts could command the military or police.

Even if legislative bodies did order churches and businesses closed, and governors and mayors were just enforcing those laws, the laws would be profoundly unconstitutional. The Free Exercise Clause of the First Amendment firmly establishes freedom of religion as a fundamental liberty and the Due Process Clause of the Fifth Amendment firmly establishes your right to purchase a lawful product in interstate commerce from a willing seller as fundamental.

Fundamental liberties are in the highest category of liberty, akin to freedom of conscience and speech and press and privacy and travel.

Let’s say you are at a big-box store looking for groceries and other items. The government cannot constitutionally limit your choices to food and paper towels if you prefer to buy grass seed and a garden hose. These are intimate personal decisions. You need not explain or justify them to the government and you don’t need a government permission slip to exercise your free will and make those choices.

Until Now.

Now, we have become a nation of sheep. We have elected officials with constitutionally assigned duties — and constitutionally imposed limitations — who have assumed to themselves dictatorial powers and have falsely claimed that they can interfere with our personal choices. Who are the governors to decide which human activities are essential? Abortion is essential but Mass is not? No constitution gave them that power.

There are two schools of thought on the impairment of fundamental liberties. One requires strict scrutiny and the other requires due process. The strict scrutiny standard mandates the existence of a compelling state interest addressed by the least restrictive means. The procedural due process standard mandates a trial at which the state must prove fault or guilt. The substantive due process standard puts certain personal decisions beyond governmental reach.

Closing churches meets no constitutional standard. There is no question that fighting a pandemic is a compelling state interest, yet there are far less restrictive ways to address it than preventing worship. Wearing masks and gloves, staying 10 feet apart, holding Mass outdoors, even taking a personal risk and then self-quarantining are far less restrictive and constitutionally offensive than closing churches.

New York City Mayor Bill de Blasio violated his oath to uphold the Constitution when he threatened to use force to close permanently all houses of worship that defied his guidelines. And a small-town police department in northern New Jersey exquisitely violated the constitutional rights of Catholics — while enforcing the ever-changing whims of Gov. Phil Murphy. The police claimed they were following the governor’s orders when they barred a priest on Palm Sunday from distributing palms in sealed plastic bags while he and each parishioner wore masks and gloves and were six feet apart in the fresh outdoors.

Enough is enough.

The employment of government power to assault personal liberty and cut constitutional corners is never justified in a free society, no matter the exigency. The Constitution protects our rights in good times and in bad. Those in power who steal freedom are unworthy of office. But don’t expect them to give us our freedoms back. We will need to pry it away from their cold and covetous hands.

This article first appeared at Lew Rockwel.Com

..

CONGRATULATIONS!

We finally did it…give yourself a pat on the the back!

We could not have done it without your cooperation and assistance.

..

On March 24 Bill Gates gave a highly revelatory 50-minute interview (above) to Chris Anderson. Anderson is the Curator of TED, the non-profit that runs the TED Talks.

The Gates interview is the second in a new series of daily ‘Ted Connects’ interviews focused on COVID-19. The series’s website says that:

TED Connects: Community and Hope is a free, live, daily conversation series featuring experts whose ideas can help us reflect and work through this uncertain time with a sense of responsibility, compassion and wisdom.”

Anderson asked Gates at 3:49 in the video of the interview – which is quickly climbing to three million views – about a ‘Perspective’ article by Gates that was published February 28 in the New England Journal of Medicine.

“You wrote that this could be the once-in-a-century pandemic that people have been fearing. Is that how you think of it, still?” queried Anderson.

“Well, it’s awful to say this but, we could have a respiratory virus whose case fatality rate was even higher. If this was something like smallpox, that kills 30 percent of people. So this is horrific,” responded Gates.

“But, in fact, most people even who get the COVID disease are able to survive. So in that, it’s quite infectious – way more infectious than MERS [Middle East Respiratory Syndrome] or SARS [Severe Acute Respiratory Syndrome] were. [But] it’s not as fatal as they were. And yet the disruption we’re seeing in order to knock it down is really completely unprecedented.”

Gates reiterates the dire consequences for the global economy later in the interview.

“We need a clear message about that,” Gates said starting at 26:52.

“It is really tragic that the economic effects of this are very dramatic. I mean, nothing like this has ever happened to the economy in our lifetimes. But … bringing the economy back and doing [sic] money, that’s more of a reversible thing than bringing people back to life. So we’re going to take the pain in the economic dimension, huge pain, in order to minimize the pain in disease and death dimension.”

However, this goes directly against the imperative to balance the benefits and costs of the screening, testing and treatment measures for each ailment – as successfully promulgated for years by, for example, the Choosing Wisely campaign – to provide the maximum benefit to individual patients and society as a whole.

Even more importantly, as noted in an April 1 article in OffGuardian, there may be dramatically more deaths from the economic breakdown than from COVID-19 itself.

Read more at The Duran

In the beginnings of the structure of society they were subjected to brutal and blind force; afterwards-to Law, which is the same force, only disguised. I draw the conclusion that by the law of nature right lies in force. – Protocol No.1 The Protocols of The Meetings of The Learned Elders of Zion

The whole world is coerced into a lockdown by governments because of a plandemic (No its not a wrong spelling ). Its the (new) word for a pandemic which was planned.

I’m not going to argue about the authenticity of the coronavirus. There are enough reports and articles out there for one to decide which are fakes or facts.

For a fact, I’m writing withing the four walls of my home. I am placed under a Restriction Movement Order (RMO), whatever that means, but my freedom of movement on the land as guaranteed under The Federal Constitution has been violated.

I get daily SMS reminders from the government about the RMO and to wash my hands.

It is now a crime for me to:

> Walk in the streets

> Jogging in parks

> Travel inter-state

> Stand less than 6 ft from another human being

Of course all these orders are for my own safety and good to protect me from the dangers of being infected by a invisible microbe which are here there and everywhere. Really?

Let’s not argue about that constitutionally either, as I am not a lawyer.

In the beginnings they applied brute force, then they create Laws which have the same force, but more subtly, and now they have Orders, which is a bigger force and very brutal.

I love philosophy (and The Beatles too), but will not get philosophical about the current madness.

I’ll just end with the wise words of Rumi:

“Out beyond ideas of wrongdoing and rightdoing there is a field.I’ll meet you there. When the soul lies down in that grass the world is too full to talk about.”

..

LATEST UPDATE – April 04, 2020

…a video done by a former higher-up at Vodafone turned whistleblower who exposed plans the elites had years ago to roll out 5G across the world. In it, he mentions how detrimental the high-frequency radio waves emitted from 5G towers are and the damage they cause to biological organisms.

But also, those who support the technology’s implementation knew how dangerous it was to human health.

Initially, there is no noticeable effect, but after about 6 months of constant exposure like the guinea pig subjects in Wuhan experienced, the body begins to break down and react adversely to the radiation poisoning.

As you may have heard by now, Wuhan was the first major city where 5G technology and towers were rolled out, sadly making it a testing ground for the technology.

As it turns out, very common side effects of radiation poisoning are “flu-like” symptoms.